Naira’s New Dawn: CBN Revitalizes Forex Market with Strategic BDC Sales

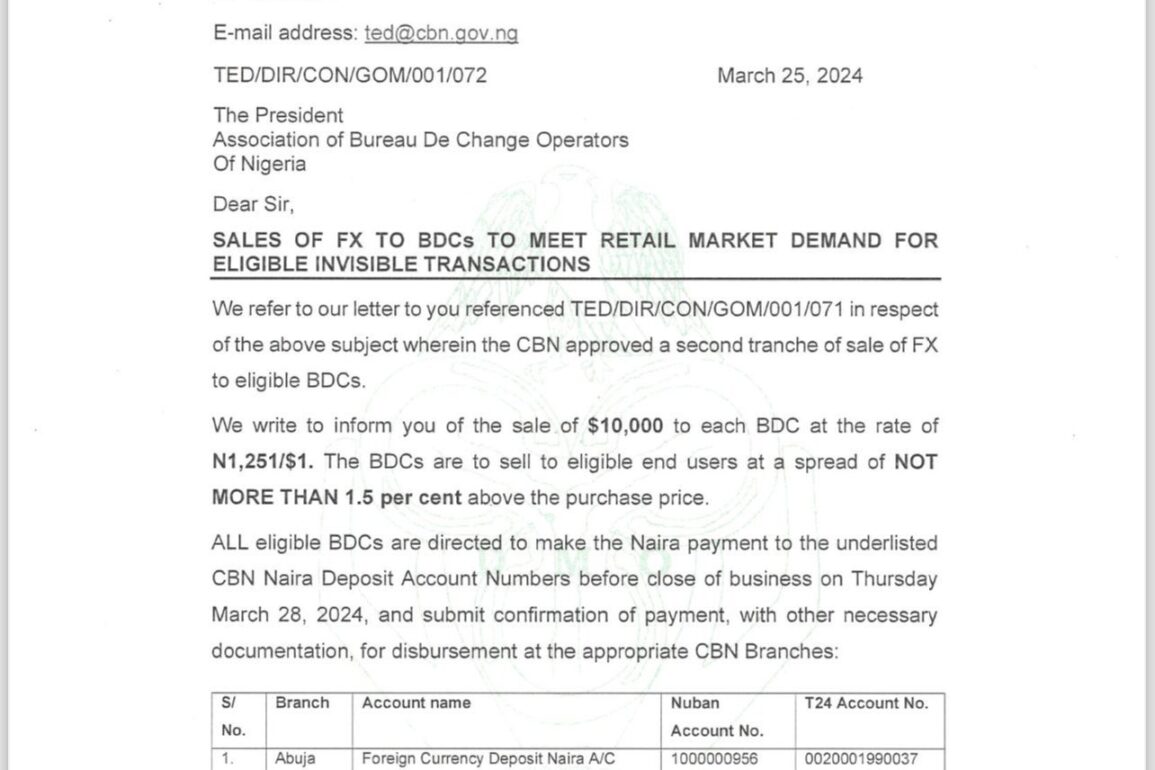

In a groundbreaking development, the Central Bank of Nigeria (CBN) has rejuvenated the forex market by resuming sales to Bureau De Change operators (BDCs) at a competitive rate of N1,251/$1, signaling a robust comeback for the Naira.

According to a circular obtained by Nairametrics, the CBN has authorized each BDC to sell the acquired dollars to eligible customers at a maximum rate of 1.5% above the purchase price, effectively capping the selling price at N1,269/$1.

This policy shift marks the end of a prolonged suspension initiated in 2021 and follows the revocation of over 4,173 BDC licenses earlier this year. With approximately 1,500 BDC licenses currently active, it’s estimated that over $15 million has been injected into the retail market.

The CBN’s strategic move aims to enhance liquidity, stabilize the forex market, and bridge the gap between official and parallel market rates. This is a significant pivot from the previous era of fixed exchange rates, which often led to price arbitrage.

By fostering a market-determined exchange rate environment, the CBN is eliminating incentives for arbitrage, thus promoting a more transparent and efficient market. This initiative is expected to benefit retail and small-scale enterprises significantly.

With the Naira showing signs of strength and the exchange rate dipping below N1,400/$1 in the parallel market, experts from Nairametrics anticipate a potential short-term surge in the currency’s value. This optimistic outlook is further bolstered by the anticipated hike in MPR rates at the upcoming CBN meeting.