Cbn Lifts Ban On Fintech Firms: Opay, Moniepoint, Others To Register New Customers From July

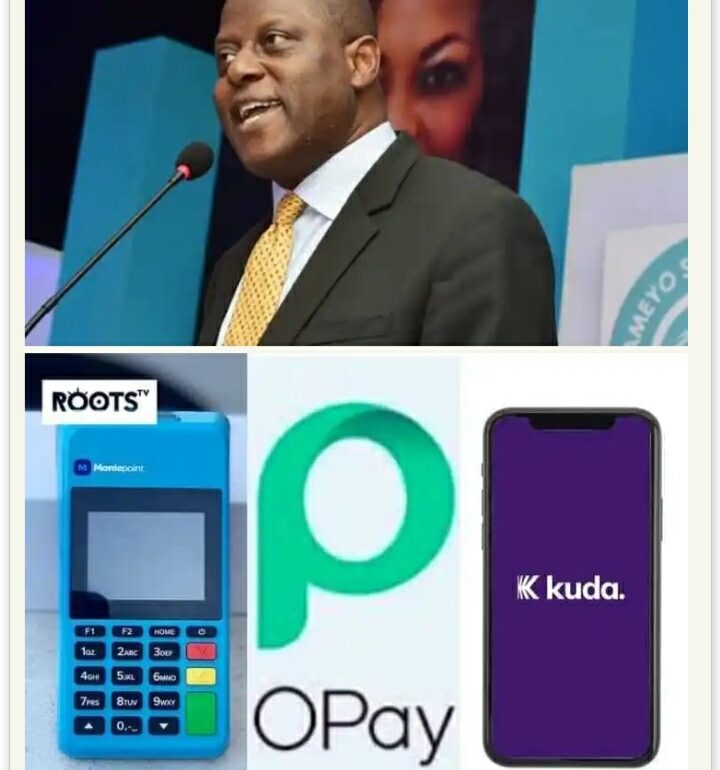

In a surprise move, the Central Bank of Nigeria (CBN) has announced that mobile money operators, including fintech firms like Opay, Palmpay, Kuda, and Moniepoint Microfinance Banks, will resume enrolling new customers in just a couple of months.

CBN Governor, Mr Olayemi Cardoso, disclosed at the end of the 295th Monetary Policy Committee (MPC) meeting in Abuja on Tuesday, stating that the CBN has engaged with many players in the sector to strengthen their operations.

According to Cardoso, the CBN introduced measures to tighten the sector’s regulations, including stricter know-your-customer requirements, to prevent money laundering and illicit flows. He expressed confidence that the sector will bounce back stronger within two months.

Cardoso denied reports that the CBN was clamping down on fintech firms, stating that they have not been singled out for exceptional treatment. Instead, the CBN is proud of its achievements and will continue to support them while ensuring regulations and surveillance are in place.

The CBN’s move to halt new customer onboarding in April was part of a broader effort to address illicit flows and money laundering in the non-traditional banking system, including cryptocurrencies.

Cardoso emphasized the importance of regulation in the rapidly growing sector, stating that the CBN will continue to support fintech firms while ensuring the integrity of the financial system.

This development is a welcome relief for fintech firms and mobile money operators, who have been eagerly awaiting a resolution to the impasse. With the CBN’s announcement, the sector is poised for a resurgence, and new customers can soon expect to be enrolled in the coming months.