FG Launches N200 Billion Palliative Programmes For Businesses

The Federal Government of Nigeria has launched two palliative programmes to cushion the effects of the fuel subsidy removal on businesses and citizens.

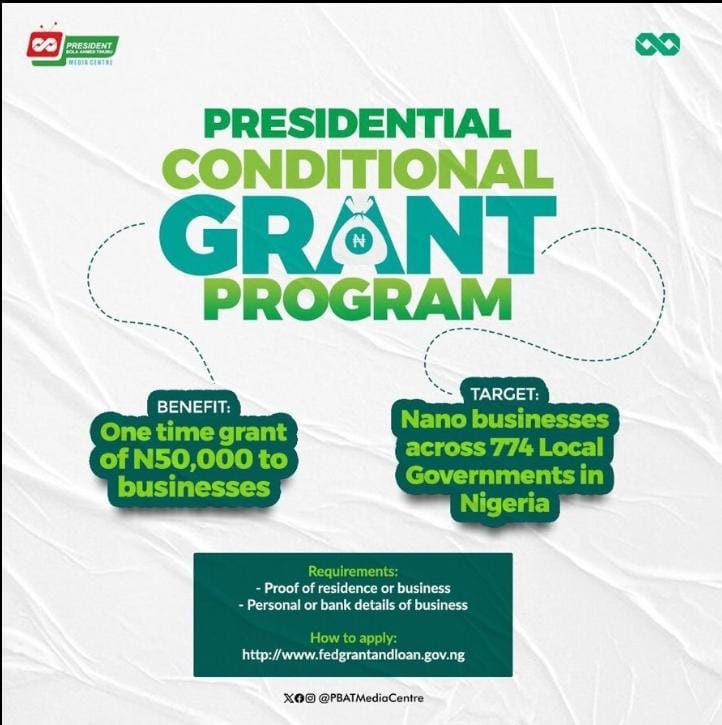

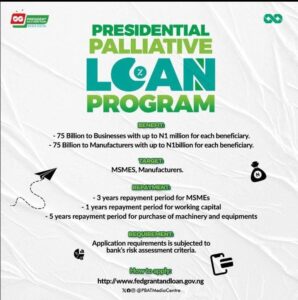

The programmes are the Presidential Conditional Grant Programme and the Presidential Palliative Loan Programme, which are aimed at supporting nano businesses, micro, small and medium-sized enterprises (MSMEs), and manufacturers.

The Honourable Minister for Industry, Trade and Investment, Dr Doris Uzoka-Anite, CFA, announced the kick-off of the programmes in a press release on Monday.

According to the statement, the Presidential Conditional Grant Programme will disburse a grant sum of N50,000.00 (Fifty Thousand Naira) to each of the 774 local government areas in the country, targeting nano businesses that are willing to provide proof of residential/business address and relevant personal and bank account information, including Bank Verification Number (BVN).

The statement added that the Federal Ministry of Industry, Trade and Investment and Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) will collaborate with State and Local Governments, Federal Legislators, Federal Ministers, Banks and other Stakeholders to ensure the successful implementation of the programme.

The Presidential Palliative Loan Programme, on the other hand, will disburse N75 billion to MSMEs across various sectors and N75 billion specifically to Manufacturers at a single-digit interest rate of 9% per annum.

The statement explained that MSMEs can access loan facilities up to N1 million with a repayment period of three years, while manufacturers can access up to N1 billion for working capital or purchase of machinery and equipment with a repayment period of one year or five years respectively.

The statement further stated that MSMEs and manufacturers can apply for the loans by submitting their application on the portal provided for the programme, and that the facility would be accessed through their banks, subject to the risk assessment criteria of their respective banks.

The Federal Government expressed its commitment to promote economic development, entrepreneurship and financial empowerment through these initiatives, and urged the beneficiaries to make the best use of the opportunities.