Financial Frenzy: Paystack And Piggyvest Acquire Brass Bank & Fire CEO

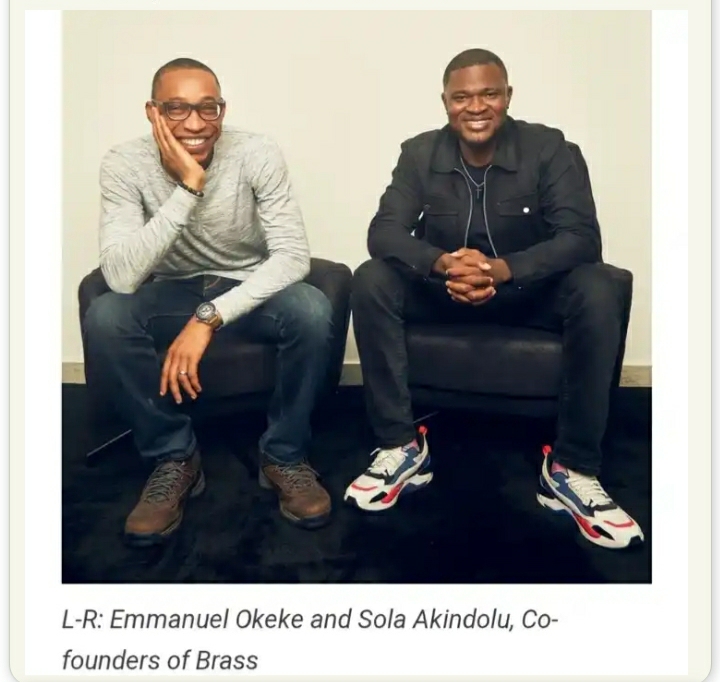

In a dramatic turn of events that has shaken the Nigerian fintech scene, the digital banking platform for burgeoning businesses, Brass, has been snatched up by an investment syndicate helmed by the formidable Paystack. The consortium, a veritable who’s who of the investment world including PiggyVest, Ventures Platform, P1 Ventures, and the astute angel investors Olumide Soyombo and Oo Nwoye, has sealed the deal that will see Brass’s co-founders, Sola Akindolu and Emmanuel Okeke, bid adieu to the enterprise they birthed.

The acquisition, which has sent shockwaves across the industry, comes on the heels of a controversial period for Brass, marked by a sudden and unsettling suspension of customer withdrawals—a move the company attributed to a crippling funding freeze.

Despite the turbulence, the acquisition assures that neither the loyal customers nor the dedicated employees of Brass will face any immediate upheaval, as the product offerings are set to remain unchanged. In a statement brimming with optimism, outgoing CEO Akindolu declared, “Brass will forge ahead, continuing to nurture and support our clientele and flourish under the stewardship of a fresh leadership team, as the founding fathers venture forth in pursuit of new horizons.”

The investment group, each member a seasoned veteran in the art of nurturing financial service products, is poised to inject a fresh wave of capital into Brass, setting the stage for an exhilarating new chapter of growth. This sentiment was echoed in a statement from Paystack, which read, “With years of experience and a new capital infusion, we’re thrilled to propel Brass into its next phase of expansion.”

This bold acquisition by Paystack, a mere three months after Brass’s inability to grant customers access to their funds, casts a spotlight on the company’s prior struggles with a funding freeze and the nation’s economic challenges. Prior to this, Brass had successfully courted over $2 million from investors.

March 2024 saw Brass secure a vital capital boost, enabling the beleaguered company to resume processing withdrawals for the affected businesses, offering a glimmer of hope amidst the financial gloom.

The strategic move by Paystack and PiggyVest to annex Brass is a calculated play to cement their presence in a sector that dovetails neatly with their existing operations. PiggyVest, traditionally a titan in consumer finance, recently expanded its empire into the realm of social payments with the acquisition of Pocket (formerly Abeg). Paystack, meanwhile, has carved out a niche in crafting payment solutions for businesses across Africa, potentially funneling a stream of clientele towards Brass.

As Brass stands on the precipice of a new era, the anticipation of new leadership looms large, though no official proclamations have been made. The interim leadership faces the daunting task of restoring the shaken confidence of customers following a tumultuous period for the four-year-old startup.

In a revelation that has sent ripples of concern through the market, TechCabal reports that Brass is saddled with a staggering ₦2 billion debt—a financial puzzle that the current leadership seems unable to solve. While the acquisition heralds a promising venture for Paystack and Piggytech, it may also usher in a legacy of liabilities that could outweigh the assets.

Stay tuned as we continue to unravel the twists and turns of this financial saga.